Telecom Infrastructure Industry Technology Trends: $246.78B in 2024 to $409.21B by 2033

Global Telecom Infrastructure Market Expands Amid Rapid 5G Deployment and Broadband Growth

US telecom infrastructure market grew to $246.78B in 2024 and is set to reach $409.21B by 2033, expanding at a 5.78% CAGR.”

AUSTIN, TX, UNITED STATES, September 23, 2025 /EINPresswire.com/ -- Market Size and Forecast— DataM Intelligence 4Market Research LLP

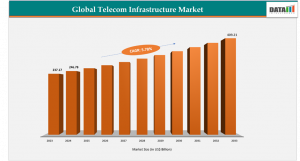

The global telecom infrastructure market, valued at US$ 237.17 billion in 2023 rising to US$246.78 billion in 2024 and is projected to reach US$409.21 billion by 2033, expanding at a CAGR of 5.78% from 2025 to 2033. Market expansion is fueled by rapid 5G rollouts, broadband network expansion, and surging demand for high-speed, low-latency connectivity across urban, suburban, and rural regions. Telecom infrastructure including cell towers, fiber-optic networks, and small cells forms the backbone for mobile communications, enterprise connectivity, and next-generation digital applications.

Technological advances such as 5G Standalone (5G SA) networks, cloud-native cores, and network virtualization are enhancing network capacity, efficiency, and reliability. Strategic collaborations between telecom operators, technology providers, and infrastructure firms are further enabling scalable, resilient, and cost-effective networks.

Market Size & Forecast

✦ 2024 Market Size: US$246.78 Billion

✦ 2033 Projected Market Size: US$409.21 Billion

✦ CAGR (2025–2033): 5.78%

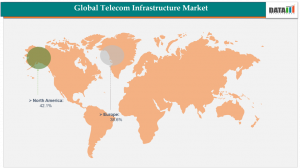

✦ North America: Largest market in 2024

✦ Europe: Fastest-growing market

Download Your Sample PDF Today and (Get Priority Access With a Corporate Email ID For Faster Delivery):- https://www.datamintelligence.com/download-sample/telecom-infrastructure-market

Key Trends

Global 5G Expansion: Virgin Media O2 & EE launched major 5G SA networks in the UK in 2024, boosting ultra-fast connectivity.

European Rollouts: Vodafone Germany, Ice Norway, and Free France deployed next-gen 5G in 2024, marking a global telecom shift.

India’s Telecom Push: DoT’s draft National Telecom Policy 2025 targets 100% 4G and 90% 5G coverage by 2030, promoting digital growth.

Regulatory Hurdles: Reliance Projects challenged Haryana’s network fees in 2024, highlighting investment barriers and deployment delays.

Drivers: Rapid 5G Deployment and Broadband Expansion

The accelerated deployment of 5G networks and expansion of broadband services remain key growth drivers. Worldwide, mobile operators have intensified 5G strategies, launching 5G SA networks that rely solely on cloud-based 5G cores rather than older 4G networks. Prior to 2024, only a limited number of carriers had implemented 5G SA, but launches by Virgin Media O2, EE, and Vodafone in the UK, along with Vodafone Germany, Norway’s Ice, and Iliad Free in France, illustrate rapid adoption.

In India, the Department of Telecommunications (DoT) released its draft National Telecom Policy 2025, targeting 100% 4G population coverage and 90% 5G coverage by 2030. The policy also emphasizes doubling telecom exports, supporting startups, and strengthening India’s global telecom research and innovation presence, presenting significant opportunities for infrastructure growth.

Restraint: High Capital and Maintenance Costs

Despite strong demand, high capital investment and ongoing maintenance costs remain challenges. Building, operating, and upgrading telecom infrastructure, including towers, fiber networks, and small cells requires significant expenditure. Regulatory compliance and rights-of-way approvals further increase operational complexity.

For instance, Reliance Projects approached the Supreme Court to challenge Haryana’s municipal and panchayati raj laws regarding network erection and maintenance fees, citing conflicts with the Telecommunications (Right of Way) Rules, 2024. Such disputes highlight the regulatory and financial hurdles that can slow infrastructure deployment.

Key Players

Infineon Technologies AG

Huawei Technologies Co., Ltd.

Cellnex

Tele fonaktiebolaget LM Ericsson

Nokia

Cisco Systems, Inc

Juniper Networks, Inc.

SAMSUNG

NEC Corporation

ATC TRS V LLC

Get Customization in the report as per your requirements:- https://www.datamintelligence.com/customize/telecom-infrastructure-market

Regional Analysis

North America’s Dominance

North America held a 42.1% share of the global telecom infrastructure market in 2024.

North America accounted for the largest share of the global telecom infrastructure market in 2024. Growth is driven by extensive 5G deployments, private and public broadband networks, and significant investment from both telecom operators and institutional investors. For instance, Apollo Global Management, in collaboration with Lendlease, acquired a US telecommunications platform that includes both operating and contracted cell towers, reflecting strategic investments to expand network coverage and capacity.

Europe captured 38.6% of the global telecom infrastructure market in 2024.

Federal initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and BEAD program further support broadband expansion in underserved regions. Combined with strong R&D capabilities, advanced network engineering expertise, and robust private-sector investments, North America continues to lead globally in telecom infrastructure development.

Market Segmentation

Technology: 5G holds around 53.4% share of the global telecom infrastructure market.

5G Segment Leading Global Demand

The 5G segment holds the largest share of the global telecom infrastructure market, driven by its critical role in delivering high-speed, low-latency connectivity for consumer, enterprise, and industrial applications. Operators are increasingly investing in 5G SA networks, small cells, and cloud-native cores to enable IoT, autonomous vehicles, immersive media, and other next-generation digital services.

A key instance is Accenture’s acquisition of Fibermind, an Italy-based network services company specializing in fiber and mobile 5G deployment. The deal enhances Accenture’s capabilities in network engineering and enables clients to leverage automation, AI, and data-driven solutions for accelerated 5G rollout and improved operational efficiency.

Buy Now & Get Instant Access to 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=telecom-infrastructure-market

Conclusion

The global telecom infrastructure market is poised for long-term growth, driven by 5G deployment, broadband expansion, and rising demand for high-speed connectivity. North America remains the dominant region, supported by strategic investments, technological leadership, and public-private initiatives. However, high capital and regulatory costs continue to pose challenges. With continued innovation, partnerships, and policy support, the telecom infrastructure market is well-positioned to enable the next wave of global digital transformation.

Why Choose This Global Defense Electronics Market Report?

• Latest Data & Forecasts: In-depth, up-to-date analysis through 2033

• Regulatory Intelligence: Guidance on spectrum allocation, right-of-way rules, and telecom policies

• Competitive Benchmarking: Evaluate strategies of Infineon Technologies AG, Telefonaktiebolaget LM Ericsson and emerging players

• Emerging Market Coverage: Coverage of North America, Europe, and high-growth digital economies

• Actionable Strategies: Identify opportunities, mitigate risk, and maximize ROI

• Expert Analysis: Research led by industry specialists with proven track records

Empower your business to stay ahead of regulatory shifts, market disruption, and climate-driven trends. Request your sample or full report today.

Related Reports

Telecom Towers Market

Telecom Power Systems Market

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.